|

|||

|  |

|

|

Guest Columns

Perspective:

Dairy Markets

Expect the unexpected in markets

Eric Meyer

Eric Meyer is the founder and president at HighGround Dairy*, Chicago, a firm specializing in dairy risk management, market analysis, hedge advisory and insurance services. He contributes this column exclusively for Cheese Market News®.

|

When I wrote my last column back in early March, Chicago Mercantile Exchange (CME) spot block and barrel Cheddar prices were languishing below $1.50 per pound as domestic demand struggled throughout the first quarter, even though milk production had been in decline for seven consecutive months, total cheese output was also negative and worst yet, January Cheddar production had plummeted by nearly 8% from 2023, its fourth consecutive month of year-on-year declines. Demand, or lack thereof, had taken prices down to levels to start the year in a way that most industry participants did not see coming.

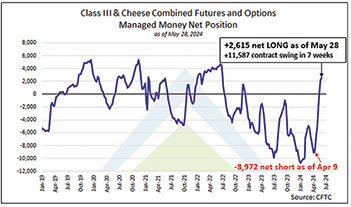

However, after bottoming out in late March, the CME spot cheese market endured the sharpest and fastest rally since 2020 (induced by COVID-19 disruptions). Block Cheddar spiked by $0.5875 per pound, or over 42%, from $1.3925 on March 22 to $1.98 by May 9, and barrel Cheddar surged over $0.70 per pound, from $1.42 on March 27 to $2.1250 per pound by May 17. The market went from extremely bearish to quite bullish in just a seven-week period. Strong cheese export data published in early April kickstarted the rally, while news of a “mystery virus” infecting dairy cattle within the Texas Panhandle, now known as Highly Pathogenic Avian Influenza, which has trimmed milk per cow on impacted dairies, slowed cheese production in Texas, tightening Cheddar supply. Throwing gasoline on the bull run during this timeframe was the behavior of large speculators, or Managed Money, within the CME Class III milk and cash-settled cheese futures markets, who moved from a near record “short” position to “long” in a very tight window, per the Commodity Futures Trading

Commission’s Commitment of Traders

Report, published every Friday. In essence, market participants who position themselves to simply make money by trading dairy futures went from betting on the market to remain low, to switching sides and betting on them to move higher at a historic rate.

Over the past two months, fundamental data has backed up the recent rally as cheese exports have remained incredibly firm, with record volumes over the past three months, while Cheddar exports from February to April are up more than 14 million pounds or 34% above the prior year, representing nearly 350 loads of product.

Meanwhile, though total U.S. cheese production has rebounded to be 1.8% above the prior year in April after trailing 1.1% during the first quarter of 2024, Cheddar production has really struggled as output of other varieties, particularly Mozzarella, has driven the recent gains. February to April Cheddar output has fallen by more than 58 million pounds from the previous year (not Leap Year adjusted), which represents a 5.6% decline, or a loss of more than 1,400 loads during that timeframe. While restaurant store traffic has struggled for more than a year now, 2024 domestic retail cheese demand has been firm so far this year, which has helped create the product mix shift in cheese away from Cheddar and thus, the recent market squeeze.

So what’s next for U.S. cheese price direction for the remainder of 2024? First, I think it is important to “expect the unexpected.” Industry analysts did not expect CME spot prices to last below $1.50 per pound from December through March, nor did they see a run to and above $2.00 either in such a short timeframe. While second half 2024 futures that hovered near a $1.80 per pound average during the first quarter looked incredibly expensive when CME spot prices were at or below $1.50, those levels look fantastic now.

Expectations of 30- to 40-cent or even wider swings within a 60-day timeframe has now become more the norm than the exception. This should be factored in when making hedge decisions.

From a fundamental standpoint, CME cheese prices below $1.60 per pound seem far in the rearview mirror. While global milk production will improve in the coming months (albeit slow and gradual), demand for cheese has rebounded, and global prices have also improved significantly, tightening the spread to the U.S. market.

The recent rally at the CME has likely prevented incremental export business into the second half of 2024, but it will not take much of a price decline to become competitive again. That said, $2.00 cheese will likely present challenges to non-Cheddar domestic demand, meaning more CME-eligible product will become available.

That is, of course, if avian influenza does not become a larger story for the dairy industry, or a hotter than average summer persists. My expectation is for U.S. Cheddar prices to remain rangebound between $1.80 and $2.00 per pound for the remainder of the year. Into 2025, more cheese capacity will be coming online, which could bring a slightly lower price band, though we should all know to “expect the unexpected” when it comes to the CME spot cheese market, and we do not expect trader behavior to change anytime soon.

CMN

The views expressed by CMN’s guest columnists are their own opinions and do not necessarily reflect those of Cheese Market News®.

*These observations include information from sources believed to be reliable, but no independent verification has been made and therefore their accuracy and completeness cannot be guaranteed. Opinions and recommendations expressed are the opinion of the authors and are subject to change without notice. The risk of loss in trading futures contracts or commodity options can be substantial, and investors should carefully consider the inherent risks of such an investment in light of their financial condition.

| CMN article search |

|

|

© 2025 Cheese Market News • Quarne Publishing, LLC • Legal Information • Online Privacy Policy • Terms and Conditions

Cheese Market News • Business/Advertising Office: P.O. Box 628254 • Middleton, WI 53562 • 608/831-6002

Cheese Market News • Editorial Office: 5315 Wall Street, Suite 100 • Madison, WI 53718 • 608/288-9090