|

|||

|

|

|

|

Guest Columns

Perspective:

Dairy Markets

Dairy expansion in progress

Mike McCully

Mike McCully is president and owner of McCully Consulting, South Bend, Indiana, a strategic consulting firm focusing on dairy and food companies, and serves as a member of the American Dairy Products Institute’s Center of Excellence.

|

There is over $7 billion in new milk processing capacity currently under construction in the U.S., and seemingly growing every month. That is a strong signal that companies are willing to invest significant amounts of money to supply a growing demand for dairy products, in both the domestic and export markets.

This also stands in contrast to Europe and Oceania where little new investment is taking place as future milk growth is limited.

The investment wave is spread over multiple dairy products but with the majority in cheese and whey and fluid milk plants. New cheese plants include Great Lakes Cheese, Hilmar Cheese and Leprino, along with expansions at Valley Queen, Bongards and Grande. Most of these will also include additional capacity for whey protein production. In fluid milk beverages, Walmart’s two new plants in Georgia and Texas are the only significant investment in HTST (high-temperature, short-time) milk. However, there are multiple new plants being built to produce ESL (extended-shelf-life) and aseptic dairy and non-dairy beverages. These new plants will help address a segment that has lacked capacity for years, potentially to the point of being overbuilt for a while. There are only a couple investments in butter, milk powder, cottage cheese, sour cream and ice cream, but they are mostly large-scale projects.

It is also worth looking at who is making these investments. Most are being made by private companies including dairy processors and food companies with brands like Fairlife and Daisy. Several plants are being built by groups of large dairy farms, such as Cayuga, Idaho Milk Products and Suntado. This continues a trend where large farms are forward integrating up the value chain on their own. To a lesser degree, investment from dairy cooperatives include new plants or expansions from California Dairies Inc., Darigold, Bongards, Upstate and Tillamook.

While this is an exciting time for the U.S. dairy industry, the wave of investment has raised a number of questions. Where will the milk come from? Where will the product go? Who will lose out on milk and product sales? Will we have enough product to meet growing export demand? There is a lot of uncertainty looking out over the next few years. For some, it will bring opportunities, while for others, it will create new challenges.

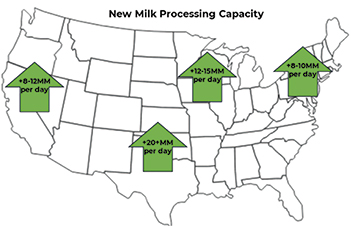

To put into perspective the needs of these new plants, the map above shows their daily milk usage by region. In total, between 50 million to 60 million pounds per day of new milk processing capacity is coming online over the next one to two years. Given limited ability to grow milk during that period, plants will be chasing milk as areas of cheap, surplus milk have attracted new demand. This is in contrast to years of milk chasing plants in order to attract more investment.

Where will the milk come from for these new plants? Companies are not investing hundreds of millions of dollars in new plants and expansions and then wonder where they will get milk from. Most, if not all, of these companies locked in future milk supply commitments before construction even started. As premiums increase, farmers will have the incentive to grow milk in some areas.

The more relevant question is, “Who won’t get the milk?” In some regions, plants will fight for milk with higher premiums. There could be plants that don’t get all the milk they need or have been used to getting. Plants that perform balancing functions for certain regions will likely handle less milk, presenting challenges to their operational efficiency and financial performance. So far in 2024, four cheese plants have closed, and there are likely more to come over the next few years.

Maybe less discussed are the changes occurring in fluid milk, with multiple new plants producing ESL beverages. Several of these plants are located around the edge of the Southeast, where local milk supplies are falling. These plants are well positioned to take advantage of growing demand in that area in the future.

The new Walmart plants will put pressure on existing plants in those regions, which also brings implications for supplying school milk in multiple states. In short, the combination of new processing capacity and declining fluid milk consumption will further the trend of plant consolidation.

While dairy markets always present challenges, the future for the U.S. dairy industry seems bright. Long-term trends are positive for dairy demand, and with limited supply growth in major export regions, the U.S. dairy industry is well positioned to take advantage of those trends. Companies are investing in growth and producing products consumers are demanding. The challenge for dairy farms and plants will be to determine how their business can prosper in this growing industry.

For a more in-depth presentation and discussion, I will be presenting on plant investments and how they will impact supply and demand in the future at the American Dairy Products Institute’s (ADPI) Dairy Ingredients Seminar, Dec. 9-11 in Santa Barbara. As a member of the ADPI Center of Excellence, I am also available for consultation to ADPI member organizations. Visit www.ADPI.org for more information.

CMN

The views expressed by CMN’s guest columnists are their own opinions and do not necessarily reflect those of Cheese Market News®.

| CMN article search |

|

|

© 2024 Cheese Market News • Quarne Publishing, LLC • Legal Information • Online Privacy Policy • Terms and Conditions

Cheese Market News • Business/Advertising Office: P.O. Box 628254 • Middleton, WI 53562 • 608/831-6002

Cheese Market News • Editorial Office: 5315 Wall Street, Suite 100 • Madison, WI 53718 • 608/288-9090