|

|||

|

|

|

|

Guest Columns

Perspective:

Dairy Markets

Be thankful for relative price stability

Dave Kurzawski

Dave Kurzawski is a senior broker with StoneX Group Inc.*, Chicago, a global financial services firm offering customized plans and tools to help clients protect margins and manage volatility. He contributes this column exclusively for Cheese Market News®.

|

I’ve been a caddy, a grocery bagger, a delivery truck worker, a roofer, and I used to run drugs (for a family pharmacy before they all closed). I even dressed as a penguin during “Christmas lights” at the Brookfield zoo, but that was mainly to get a girl’s number. It’s no wonder that I sought out the dairy industry for my career. The only constant in dairy markets is that they are ever changing. New data — and new opinions — are molded daily, which is why the recent price stability to markets is both welcomed — and a little unnerving.

After spiking to $2.3150 in mid-September, the cash block cheese price fell back to around $1.90 per pound at the beginning of October and has remained there ever since. After 30-cent-plus swings in price in both August and September, the price of blocks has meandered in a stable 6.75-cent trading range (the range for barrel cheese has been about 16 cents around the $1.90 mark in the same time frame, but that market was more unhinged this year). While a market holding steady isn’t exactly breathtaking news, the stability is a little surprising in light of the recent data and news.

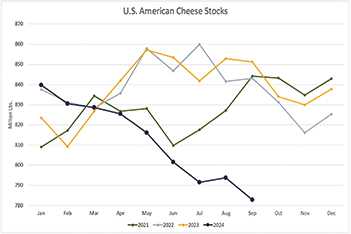

Cheddar cheese production is down 7% year-to-date. Bird flu is ripping through California, knocking back milk production in the state that produces 20% of U.S. milk, anecdotal comments of a recent uptick in tire kicking from the export buyers, and all this happened while cheese inventories continue to dwindle amid solid commercial disappearance (up about 1.3% year-over-year [YOY] since March).

Don’t get me wrong; it’s not all semi-bullish to bullish news. Headline U.S. milk production was up 0.1% from last year in September, which was stronger than the -0.3% forecast. The fat and protein content were up from last year, which put component adjusted production up 1.6% YOY, which is just below the five-year average component growth of 2%. September was the third consecutive month that production has been better than expected, and USDA made a big upward revision to August, flipping it from -0.1% to +0.4%. On-farm profit margins improved nicely this year.

We also have new cheese production capacity coming online here in late October, which kicks off several new cheese plants and plant expansions that will continue through the middle of 2025. Historically that new capacity suppresses U.S. cheese prices for a period. Add to that the forward-looking view of the markets to expect a seasonal slowdown in demand as we close out 2024 and roll into next year. And that, in a nutshell, seems to be the key theme or sentiment around cheese demand today: If it ain’t great now, what makes it better in 60 or 90 days?

The result of this thinking has flattened the spot market/futures market relationship. The spot cheese market is (as of this writing) trading right around $1.90 price average. The futures market is within 3 cents of $1.90 through December 2025. There’s no risk premium. There’s no carry. There’s no material discount going into the future. There’s just price stability as far as the eye can see.

On some level, it appears the market has found some solace in not rocking the boat ahead of two gargantuan events ahead of us: the U.S. presidential election and the final language of the long-awaited federal milk marketing order (FMMO) reform due Nov. 12. Kinda like when you freeze momentarily as someone is angrily yelling in your vicinity — you don’t want to catch any shrapnel. But you eventually move.

So far, the big picture on cheese prices over the last few months has been one of price correction within a larger bull market — not a new bear market. That is still the opinion of this piece. But the news changes — and we’re going to absorb a boatload of fresh micro and macro news over the next 30 days. And that is the takeaway — price stability is fleeting.

CMN

The views expressed by CMN’s guest columnists are their own opinions and do not necessarily reflect those of Cheese Market News®.

*This material should be construed as market commentary and not intended to refer to any particular trading strategy, promotional element or quality of service provided by the FCM Division of StoneX Financial Inc. (“SFI”) or StoneX Markets LLC (“SXM”). SFI and SXM are not responsible for any redistribution of this material by third parties, or any trading decisions taken by persons not intended to view this material. Information contained herein was obtained from sources believed to be reliable, but is not guaranteed as to its accuracy. Contact designated personnel from SFI or SXM for specific trading advice to meet your trading preferences. These materials represent the opinions and viewpoints of the author, and do not necessarily reflect the viewpoints and trading strategies employed by SFI or SXM.

| CMN article search |

|

|

© 2024 Cheese Market News • Quarne Publishing, LLC • Legal Information • Online Privacy Policy • Terms and Conditions

Cheese Market News • Business/Advertising Office: P.O. Box 628254 • Middleton, WI 53562 • 608/831-6002

Cheese Market News • Editorial Office: 5315 Wall Street, Suite 100 • Madison, WI 53718 • 608/288-9090