|

|||

|

|

|

|

Guest Columns

Perspective:

Dairy Markets

Warren Zevon’s less known track: Tribes, Echo Chambers and Cheese

Dave Kurzawski

Dave Kurzawski is a senior broker with StoneX Group Inc.*, Chicago, a global financial services firm offering

customized plans and tools to help clients protect margins and manage volatility. He contributes this column exclusively for Cheese Market News®.

|

There’s been a lot of references to a person’s “tribe” over the last handful of years. “Tribe” is used to describe differing groups of people in politics, sports, food, you name it. The conversations of differing tribes are often held in another popular term of late: an echo chamber. And it makes sense — we are social animals instinctively reliant on our tribe for safety and protection. We like talking to like-minded people.

Commodity markets have “tribes,” too. And echo chambers. These tribes are most commonly broken down into two main groups: market bulls and market bears. Simply stated, bulls think prices will rise. Bears expect prices to fall. Legend has it these terms were coined for the way each animal could kill you. Bulls gore you with horns as they lift their head up. Bears claw your face off with a paw swipe down. But I digress.

What does this have to do with the price of cheese in Chicago? The first six months of 2023 were marked by a growing number of dairy industry professionals and market participants joining the bearish tribe. Exports faltered, milk and cheese production were growing, and prices started sliding — slowly at first and then with a burst of selling energy by mid-June. It made sense to be bearish on the price of cheese. Back then.

The problem with tribes and echo chambers is that they don’t give up easy. Call it the inertia of group think.

Call it the power of having been correct. In most situations, viewing your own market opinion through rose-colored glasses is a sensible way of ensuring you stay happy with your trading positions and your tribe. But this outlook also skews your perception, meaning that even when you learn eye-opening new information, you may not feel alarmed enough to reconsider your views.

John Maynard Keynes, the father of macroeconomics, said it well: The difficulty lies not so much in developing new ideas as in escaping from old ones.

That seems to be the underlying lesson of the cheese market so far this year. The bearish camp is still brimming with tribesmen discussing bearish things while cooking up peach cobbler over an open fire.

They talk about lack of exports and a slowing economy and suggest the $2 block cheese price is “overdone.” And it might be. But it is for this reason that many market participants are simply shocked by the 70-cent spot block cheese rally in just seven weeks. Further, it’s the reason many expected the cheese market to stutter-step in the $1.90s, falter and fall, which has not yet happened. In fact, as of this writing, the price is over $2 per pound.

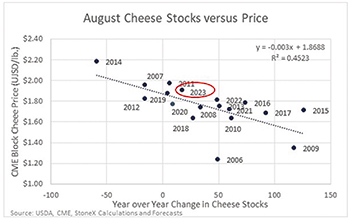

Now before you align me with the bullish camp in perpetuity, at $2 cheese I — and the rest of us at StoneX — find it hard to argue with the market bears when you look at the data. Given cheese stocks currently and given where we have cheese stocks forecast for August, our model would still suggest $1.80 cheese is the “fair” price today. And our September forecast is a little lower at $1.76 as cheaper cheese in EU/NZ takes some market share, U.S. exports weaken a bit further and inventory gets a little heavier in September.

There is hard data and then there are the commercial realities. The commercial realities are commonly labeled as “anecdotal” and tend to lead the data. Those anecdotal conversations have pointed to a significant — albeit potentially short-term (three- to six-week) — tightness on fresh cheese, which is a U.S. problem, and which has not yet abated. Why doesn’t the data purport this yet? Simply — we haven’t gotten those official reports yet.

The fallout from this will likely make exporting cheese a tough job going forward. That lack of marginal demand will presumably ease the strain on what has been a supply-driven bull cheese market lately.

But when does that matter?

With milk tightness courtesy of terrible producer profit margins (flat out big losses), hot weather, stronger culling (+7% over last year), cheese production hiccups, schools pulling on available supplies and autumn demand, we may have enough to keep us busy and prices supported right here in the good ole US of A. So, my short answer is: not yet.

And before I dig into the one pot, dehydrated bullish beef stroganoff, I’ll leave you with another timely quote by Mr. Keynes: When the facts change, I change my mind — what do you do, sir?

CMN

The views expressed by CMN’s guest columnists are their own opinions and do not necessarily reflect those of Cheese Market News®.

*This material should be construed as market commentary, merely observing economic, political and/or market conditions, and not intended to refer to any particular trading strategy, promotional element or quality of service provided by the FCM Division of StoneX Financial Inc. (“SFI”) or StoneX Markets LLC (“SXM”). SFI and SXM are not responsible for any redistribution of this material by third parties, or any trading decisions taken by persons not intended to view this material. Information contained herein was obtained from sources believed to be reliable, but is not guaranteed as to its accuracy. Contact designated personnel from SFI or SXM for specific trading advice to meet your trading preferences. These materials represent the opinions and viewpoints of the author, and do not necessarily reflect the viewpoints and trading strategies employed by SFI or SXM.

| CMN article search |

|

© 2025 Cheese Market News • Quarne Publishing, LLC • Legal Information • Online Privacy Policy • Terms and Conditions

Cheese Market News • Business/Advertising Office: P.O. Box 628254 • Middleton, WI 53562 • 608/831-6002

Cheese Market News • Editorial Office: 5315 Wall Street, Suite 100 • Madison, WI 53718 • 608/288-9090