|

|||

|  |

|

|

Guest Columns

Perspective:

Dairy Markets

Butter market is one to watch

Brian Fletcher

Brian Fletcher is vice president of commercial services at ever.ag*, a brokerage firm that specializes in dairy product price risk management. He contributes this column exclusively for Cheese Market News®.

After a couple of years of comparative quiet, the butter market is back in the headlines. The spot market is at $2.78 per pound as of this writing, a level not seen since December 2015. And the futures curve is fully inverted, with deferred month pricing well below nearby pricing, speaking to tight nearby conditions.

|

|

What’s taken us here? On the surface, it’s a simple story of supply and demand. But the factors driving those dynamics need a closer look.

It all starts with milk. Production across the globe is in a slump. U.S. output slipped 0.4% year-over-year in November, while the milking herd dropped 47,000 head versus prior-year levels. Crossing the pond to the European Union (EU), unfavorable weather and new environmental regulations are crimping milk production, which declined 0.3% year-to-date through November. Another other big export player, New Zealand, experienced wet conditions and delayed calving that knocked output down 1.5% during the same period.

There are a few bright spots of growth, like Ireland (+6.4% YTD through October) and Argentina (+4.5% YTD through November), but certainly not enough volume to pick up what was lost in the major production regions.

But does lower milk production directly mean less butterfat? Through November, U.S. total fat output was up 2.9% year-over-year, while total milk production was only up 1.8%. Less and less of that extra fat, however, is finding its way into the fresh cream market. With fluid milk declining every year over the past decade, there’s less cream spun off by bottlers. The decline in bottler-supplied cream is exacerbated by the fact that more consumers are drinking whole milk than before. Consumers are also shifting from yogurt to higher-fat items, cutting into surplus fat supplies. In the Mideast specifically, new American-style cheesemaking capacity is absorbing fat in block Cheddar that used to be devoted to balancing plants who would sell cream. Based on our calculations, we’d expect nearly 15% of the Mideast’s butterfat supply went into cheese. Recent USDA reports also point to shallow cream supplies in other U.S. regions as fluid bottling continues a downward trajectory.

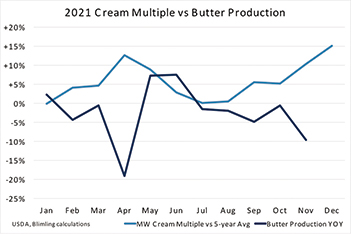

As a result, processors of butterfat products are now clamoring for pieces of a smaller pie. Consumers continue to have a positive view of butterfat, and we’re seeing increased sales of items like full-fat cream cheese and ice cream. Manufacturers of these value-added items can pay for the cream they need, but even they’re having trouble filling the schedule every week. As a result, Midwest cream multiples were 1.31 on average in 2021 versus a five-year average of 1.26. The situation leaves butter manufacturers with a choice — build inventory or sell the cream? With the futures curve inverted and multiples elevated, selling cream makes the most sense, bypassing some degree of seasonal inventory building. Looking over the last year, we’ve seen that play out: When cream multiples rise above the historical average, butter production falls.

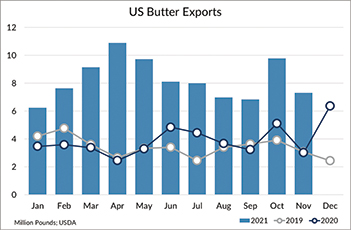

Globally, prices have risen on these tighter milk and butterfat supply conditions. EU butter production decreased to 156.3 million metric tons year-to-date through September, 3.5% lower versus 2020. The region’s exports, meanwhile, dropped 16.8%. That shortfall is sending former customers of the EU (places like the Middle East and North Africa) shopping the globe for butterfat. With New Zealand supplies limited, many buyers have come to the lower-cost U.S. to fill their needs. We’re hearing about international buyers knocking on the doors of butter and anhydrous milkfat (AMF) manufacturers in search of product. During the first 11 months of 2021, U.S. butter exports rose 124% year-over-year, while exports of AMF jumped 200%.

Domestically, demand for butterfat is also increasing. American consumers still have a strong appetite for butter, with domestic consumption rising nearly 2% year-over-year during the first 11 months of 2021. For wholesale users of butter like process cheese manufacturers and confectioners, in years past, they would shop the global market for the best value. But higher international prices, limited supply and logistics issues are leading some buyers to keep their purchases local. Overall, this is a picture of higher demand on U.S. butterfat supplies as the world seeks to buy.

What will it take for supply and demand dynamics to evolve, bringing butter prices down from stratospheric levels? We know that markets work. At some point, buyers will say, “no, thanks,” and dairy producers will turn on the milk. While high prices eventually cure high prices, the market will likely remain elevated compared to historical figures. We suspect that the turning point will be when international buyers start shopping for cheaper butter elsewhere. Elevated butter prices mean higher milk prices, which should also encourage more milk production in the coming months.

In the meantime, it’s a good idea to listen to what the market is saying. If you make butter, there’s no incentive to hold onto it as the futures curve points to lower prices in the coming months. But it’s a different story for buyers. Unless you need it now, the market advises looking further down the board for cheaper coverage and physical buys. If you already have a commitment, consider options to create a ceiling and protect yourself against possible $3.00 butter, should the market take longer than expected to ration supply.

For more information on how to protect your financial position, contact Brian Fletcher at bkf@ever.ag or 312-492-4200.

CMN

The views expressed by CMN’s guest columnists are their own opinions and do not necessarily reflect those of Cheese Market News®.

*The risk of loss trading commodity futures and options can be substantial. Investors should carefully consider the inherent risks in light of their financial condition. The information contained herein has been obtained from sources to be reliable, however, no independent verification has been made. The information contained herein is strictly the opinion of its author and not necessarily of ever.ag and is intended to be a solicitation. Past performance is not indicative of future results.

| CMN article search |

|

|

© 2025 Cheese Market News • Quarne Publishing, LLC • Legal Information • Online Privacy Policy • Terms and Conditions

Cheese Market News • Business/Advertising Office: P.O. Box 628254 • Middleton, WI 53562 • 608/831-6002

Cheese Market News • Editorial Office: 5315 Wall Street, Suite 100 • Madison, WI 53718 • 608/288-9090