|

|||

|

|

|

|

Guest Columns

Perspective:

Dairy Trade

Building a broader foundation for dairy exports and a stronger industry

Michael Culhane

Michael Culhane is the owner of Dairy Advance Business Consulting LLC, a provider of business development and technical support services. He contributes this column exclusively for Cheese Market News®.

There was a time when a milking stool, with at least three legs required for seating, was a key piece of equipment for milk production. Running with this metaphor for a moment in the context of export growth, the U.S. dairy industry finds itself operating instead with essentially two legs to support expansion in overseas markets for primary milk products (products obtained directly from milk, excluding whey).

|

|

Primary products are the main engine for dairy business and represented 78% of U.S. dairy export value in 2018. The industry is mostly reliant on just two product categories as vehicles to market U.S. milk in primary formats. Cheese and nonfat powders accounted for 69.8% of export value from all primary milk products in 2018. This is a high degree of dependence compared with the European Union and New Zealand where the cheese and skim powder combination accounted for 50.2% and 20.4% of corresponding export sales value, respectively. Greater diversity is needed in the U.S. product mix destined for international markets.

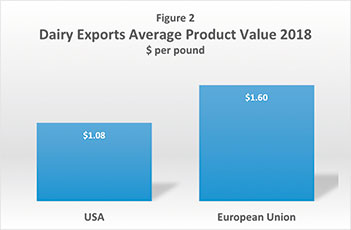

The export portfolios of major competitors like the European Union (EU) and New Zealand contain a wider range of products. This distributes milk use across a larger set of markets and generates higher returns overall. The U.S. on the other hand is not active to any significant degree in spaces such as whole milk powder, butter, fat-filled powders, casein products and infant formula. (Figure 2 demonstrates the substantial difference in the average value of U.S. and EU exports resulting largely from our absence in these and a number of other business segments.)

While structural factors constrain American participation in several of these markets, there are other opportunities that the industry is missing out on. The position is better for secondary dairy products obtained from whey. Here the U.S. is a market maker in several segments such as various whey protein and permeate/lactose ingredients. Nonetheless similar observations concerning strategic gaps in the product mix apply. The U.S. does not participate to any significant extent in several large markets capable of generating substantial added value such as demineralized whey powder and pharmaceutical lactose. In a major gap, the U.S. is an insignificant player in the international infant formula sector, exporting just 33,000 metric tons in 2018 compared to 96,000 metric tons for New Zealand and 580,000 metric tons for the European Union. This is a high-value market, and to add perspective, it’s worth noting that the European Union has 45 processing plants approved for sale of infant formula to China, including eight facilities operated by dairy processing companies. The latter companies add value with vertically integrated manufacturing and marketing of infant formula products. In the U.S. only seven infant formula plants are certified by Chinese authorities, and none are owned by milk processors.

The combined effect of overdependence on some products and limited involvement in key export segments cascades through the industry impacting producers and processors alike. The U.S. is the single largest global supplier of skim milk powders, with a market share fluctuating between 25-30% in recent years. Taking into account the U.S. dairy outlook and trends across other major suppliers, it appears that U.S. involvement and therefore dependence will grow in volume and share of business terms. While American powder

manufacturers have made great progress in upping performance and supplying high-quality products that improve competitiveness, too much is expected of this market sector in its ability to support both growth and value generation.

In a competitive and over-supplied powder market, it’s often a race to the bottom to maintain market share. We’ve seen the evidence of that hitting home since 2015. The international powder market was saturated, and it was inevitable that domestic cheese became the de facto channel for balancing the milk supply, a function it should provide on a minimal basis only. As a result the market was heavily disrupted by over-production, especially of barrel cheese. Cheese prices recovered in the second half 2019 but were driven by contraction in the milk supply rather than growth in business.

So what are options for diversifying business? A lot is expected of cheese as a driver for business development, and there’s certainly great potential in consumer markets around the world. While the cheese sector is a keystone for future growth, U.S. dairy increasingly needs export diversification. At a practical level, the industry should focus on additional market opportunities where it can leverage strategic advantages that competitors will have difficulty in matching. (Figure 3 profiles market spaces where the U.S. is minimally present for the moment. Unfortunately several of these avenues are out of reach either for structural reasons or because, quite simply, we are late to the party. Nonetheless, while it will not be easy there are remaining some substantial opportunities that should be pursued vigorously.)

Advancing diversification and facilitating innovation will deliver value and enhance competitiveness. Innovative products that expand the way cheese is presented will be demanded by global consumers, and the industry should be full ready to meet these expectations. Strategies for cheese need to be integrated and supported with parallel and synergistic development of new and diversified ingredient streams.

That this may not be easy should not be an excuse for inaction. Let’s define the opportunities and objectives, address the challenges and barriers, and figure out how to move ahead in constructing a stronger foundation for industry growth at home and in international markets.

CMN

The views expressed by CMN’s guest columnists are their own opinions and do not necessarily reflect those of Cheese Market News®.

| CMN article search |

|

|

© 2025 Cheese Market News • Quarne Publishing, LLC • Legal Information • Online Privacy Policy • Terms and Conditions

Cheese Market News • Business/Advertising Office: P.O. Box 628254 • Middleton, WI 53562 • 608/831-6002

Cheese Market News • Editorial Office: 5315 Wall Street, Suite 100 • Madison, WI 53718 • 608/288-9090