|

|||

|

|

|

|

|

|||

Guest Columns

Perspective:

Dairy Markets

Farewell and adieu to you, bearish markets

Dave Kurzawski

Dave Kurzawski, a senior broker with FCStone, Chicago, contributes this column exclusively for Cheese Market News®.

Dairy markets are bubbling up like we vote in Chicago: early and often. The “supply-side,” bear market story of 2017 is just that: last year’s news. Dairy demand take is the darling this year and it’s catching many off-guard.

In just the first three months of this year, the top 30 dairy buyers on earth —excluding China — saw imports increase by about 10 percent. This is the largest increase since 2014, and back then it was mostly China.

This year it’s demand from countries “other than China” that has my attention. It’s not just dairy. Commodity markets the world over are restless and firming now. From crude oil to lumber, one by one the risk appears to be to the upside for prices.

There are likely more than a few reasons for this — from broad-based global expansionary monetary policies over the past handful of years to strong economic growth in both the United States and in emerging markets.

In fact, according to the International Monetary Fund’s latest World Economic Outlook from April, “The global economic upswing that began around mid-2016 has become broader and stronger” (this year).

At times like these, it’s worth looking at the bigger picture. Sometimes a good way to do that is to ask: What are hedge fund managers thinking about the world today?

I realize these guys can get a bad rap. They don’t make anything. No milk, no cheese, no butter — no food. They’re coffee-slurping, corner-office profiteers. But what really matters is their underlying market sentiment — and sometimes there is no finer indicator of things to come.

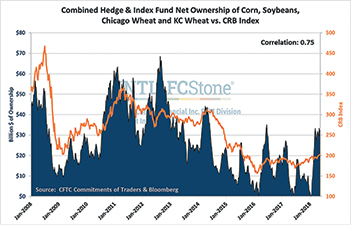

The Commodity Research Bureau or CRB Index tracks 19 different commodities across the energy, metals and agriculture markets. About 39 percent of the index is weighted to energy versus 41 percent to agriculture. The chart accompanying this column shows the net notional fund ownership in corn, beans, Chicago wheat, and KC Wheat versus the CRB Index.

|

The index itself has moved above a pivotal 200-mark (value of the index) for the first time in two years thanks to a relentless crude oil market. Funds have accumulated over a $30 billion net long position in the previously mentioned commodities. Funds are currently net long about 400,000 contracts of oil which, if you value at $70/barrel, is $28 billion notional. What does all this mean? The money-where-their-mouth-is guys are betting on higher commodity prices. All commodity prices.

Dairy prices are firming — most notably for butter where we are trading above $3/pound in Europe.

Meanwhile skim milk powder and dry whey also are moving higher now as domestic markets firm and export demand is picking up. In the first quarter of 2018 total U.S. cheese exports are up 10.8 percent, nonfat dry milk exports are up 23.3 percent, butter exports are up 51.8 percent, and dry whey exports are up 27.8 percent. And it’s not just because we’re the cheapest on the block. Economies of the world are heating up, and the dairy industry is presently running headlong into significantly better demand in 2018.

Yes, it’s possible some second half dairy demand is being pulled forward today. But it’s also plausible that bigger inflationary dynamics are just out ahead. For what it’s worth, I’d say we’re done with the bear market on dairy for awhile. But that doesn’t make it less important to be watching the world around dairy. Watch the world around commodities in general. In fact, from time to time watch those folks who couldn’t tell a bulk tank from a Bud Light but still place big bets on agriculture. Those are the people who shed light on broader trends — much of which can be related right back to the dairy industry.

CMN

The views expressed by CMN’s guest columnists are their own opinions and do not necessarily reflect those of Cheese Market News®.

| CMN article search |

|

|

© 2024 Cheese Market News • Quarne Publishing, LLC • Legal Information • Online Privacy Policy • Terms and Conditions

Cheese Market News • Business/Advertising Office: P.O. Box 628254 • Middleton, WI 53562 • 608/831-6002

Cheese Market News • Editorial Office: 5315 Wall Street, Suite 100 • Madison, WI 53718 • 608/288-9090