|

|||

|  |

|

|

Guest Columns

Perspective:

Dairy Markets

Factors affecting price

Aishwarya D. Govil

Aishwarya D. Govil is a risk management advisor at Rice Dairy,* a boutique brokerage firm in Chicago that specializes in dairy and markets at dairy’s periphery. He contributes this column exclusively for Cheese Market News®.

The cheese markets continue to redefine the term “volatile markets” as we prepare ourselves for the second half of the year. Of late, the markets have been in a state of pandemonium. We have seen nearly two limit moves in the last three trading sessions. Commodity prices are usually determined by the supply/demand dynamic but that does not mean that the markets are immune to erratic behavior. Looking at the data, I would like to present an argument that cheese prices are more demand driven than supply driven. I think it is safe to assume over a longer period of time, the markets revert back to averages and seasonality patterns do exist.

There have been some compelling bearish arguments and after briefly going to new lows, we have rebounded back sharply on spot as well as futures. Looking at historical seasonal patterns for supply and demand, let’s first talk about demand as we head into demand season in the second half of the year. Right now, enough product has been consumed in Q1 that even if we have a steady Q2, it still means that we are going to have a supply deficit to fulfill our demand. We are simply consuming more than we produce.

A fascinating number to look at is per-capita cheese consumption. Average monthly per-capita cheese consumption has grown from 2.50 pounds in 2000 to a projected 3.14 pounds per month in 2016. That is an increase of 25 percent. The population of the United States has increased about 15 percent in the same time frame. More people, consuming even more cheese. Another interesting dynamic is to look at the stock markets and oil prices. Investments are making money and people are spending less on gas. So that leaves everyone with more cash in their pockets. I think it is a fair assumption that some of that extra money is spent at restaurants.

Additionally, we have school season starting up in September. That is the start of the demand season and it only goes higher from there. Exports for cheese tend to be a little higher during the spring but that number is relatively small and does not influence prices as much as the supply/demand numbers. Q1 commercial disappearance has been up 4.25 percent year over year, which is also an all-time high for Q1. Now, because we have consumed enough product in a high supply environment and we haven’t even entered the demand season yet, I think there is bound to be some upward pressure on prices.

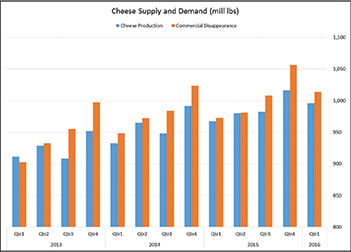

The other side of the equation is supply. Over the last 15 years, average monthly cheese production has increased from 688 million pounds in 2000 to an estimated 994 million pounds for the first part of 2016. Most of it can be attributed to increase in milk production and processing capacity. But over the last 13 quarters, average supply has increased 0.78 percent. At the same time, commercial disappearance has increased 1.03 percent.

Total Q1 production was up by 2.95 percent year over year. The inventories were up 10.80 percent year over year for March. Data show that the number of cows and pounds per cow both start falling in July before recovering by the end of the year. There have been rumblings about hot weather in the summer, which is just adding fuel to the fire. This makes me think that we are going to have a hard time keeping the supply up since flush season is already over and the cows are going to start producing less. We do have a lot of stocks but we run the risk of drawing it down with the current demand scenario.

Based on the above discussion, I believe that cheese prices are more demand driven than supply driven. Looking at 15 years of historical data, the correlation between demand and prices is a little higher than it is for production. There is a lag in the relationship between prices and the reaction toward supply. I think supply is somewhat not elastic because dairies will always make as much milk as they can to be able to cover their fixed costs.

As mentioned before, average production has increased 0.78 percent over the last 13 quarters but at the same time, commercial disappearance has increased 1.03 percent. Looking at all these factors collectively, I would argue that our high production scenario is bound to converge with long-term seasonality trends of lower production in the second half of the year. Domestic cheese consumption has been consistent and I would expect that to continue going into Q3 and early Q4.

I understand that all market situations are unique and the supply demand dynamics tend to evolve every day. But that being said the human nature of looking for patterns and trends is intense. Quite often, it becomes a self-fulfilling prophecy.

“History never repeats itself but it rhymes.” — Mark Twain.

CMN

The views expressed by CMN’s guest columnists are their own opinions and do not necessarily reflect those of Cheese Market News®.

*These observations include information from sources believed to be reliable, but no independent verification has been made and therefore their accuracy and completeness cannot be guaranteed. Opinions and recommendations expressed are the opinion of the authors and are subject to change without notice. The risk of loss in trading futures contracts or commodity options can be substantial, and investors should carefully consider the inherent risks of such an investment in light of their financial condition. Chart data from USDA.

| CMN article search |

|

|

© 2025 Cheese Market News • Quarne Publishing, LLC • Legal Information • Online Privacy Policy • Terms and Conditions

Cheese Market News • Business/Advertising Office: P.O. Box 628254 • Middleton, WI 53562 • 608/831-6002

Cheese Market News • Editorial Office: 5315 Wall Street, Suite 100 • Madison, WI 53718 • 608/288-9090