|

|||

|  |

|

|

Guest Columns

Perspective:

Dairy Markets

The block/barrel inversion — Will it ever go back to normal?

Eric Meyer

Eric Meyer is president of HighGround Dairy*, Chicago, a firm which specializes in dairy hedging, risk management and market analysis services. He contributes this column exclusively for Cheese Market News®.

History has been in the making and quietly under everyone’s radar. As of July 15, the Chicago Mercantile Exchange (CME) spot 500-pound barrel Cheddar weekly average price has settled at a premium to 40-pound colored block Cheddar for the last 12 consecutive weeks, its longest stretch in the history of the cash cheese markets. Most historical anomalies in this spread have favored a wider block premium over barrels. This time around, barrel manufacturers have been given a gift as they pay farmers a Class III milk value that is calculated using a weighted average block and barrel price.

Why the inversion in the first place? The demand trend on process cheese has been in decline for the past number of years as consumers favor natural varieties. According to USDA National Dairy Products Sales Report (NDPSR) data, barrel sales volumes during the first half of 2016 are DOWN 20.5 percent versus ten years ago. But as demand has fallen, so has production as a number of cheesemakers have either mothballed barrel facilities or converted to manufacture higher margin varieties. There has been little investment into barrel processing in recent years as a result.

As the “barrel” share of total Cheddar production has declined over the years, Cheddar as a share of total U.S. production has also gone down. Cheddar represented 33.2 percent of total cheese production back in 2005 but last year, Cheddar’s share of total cheese production was down to 28.7 percent. Nearly all of the cheese in this country is priced directly off a CME spot block or barrel average or a milk formula indirectly tied to these indices. But the total supply available of 40-pound blocks and 500-pound barrels has been contracting, meaning any short term changes in supply/demand will have an enhanced impact on CME spot prices than in years past.

Looking deeper into USDA’s Dairy Products report data, it becomes clear how the block/barrel could have become inverted. Minnesota is the second largest Cheddar producing state with at least three plants and home to a number of barrel manufacturing facilities (Texas and New Mexico are larger block Cheddar producers but state level data for those two are not reported by USDA). In May, Minnesota produced 41.9 million pounds of Cheddar, DOWN 11.5 percent versus the prior year which represented a loss of 5.5 million pounds. In fact, Minnesota’s Cheddar production has endured year-over-year declines for the past nine months! Through the first five months of the year, milk production in the state is UP 2 percent while total cheese production is DOWN 3.2 percent. This is one example of how a larger milk supply in a predominantly cheese-producing region does not necessarily equate to more Cheddar. Across the United States, Cheddar production has declined versus the prior year in three of the first five months of 2016. With strong comparisons last June through September, expectations for healthy year-over-year Cheddar production growth remain slim in 2016.

Moving to the short-term demand side of the equation, weekly NDPSR data reported strong demand for barrel Cheddar in recent weeks. For the past eight weeks ending June 25, barrel sales volumes were UP 5.6 percent, 4.4 million pounds — or more than 100 loads removed from potential sale at the CME. Prices made a multi-year low in mid-May which was the likely catalyst for stronger demand. While import demand for cheese has been up sharply in 2016 from countries like New Zealand and Lithuania (mostly in the form of frozen processing solids), those can remain on ice if there is incentive to take domestic prices higher.

Anecdotal chatter that fresh domestic processing solids were in tight supply in recent weeks have added to the bullish tone. Less barrels and more short-term demand turned into higher prices, no matter the amount of cheese in inventory.

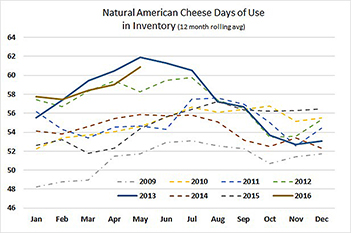

Inventories should matter in medium to longer term price outlooks, and 1.25 billion pounds of total cheese in storage (as of May 31) is a significant number. However, it is not large enough to justify resting on multi-year lows when the calendar rolls forward into summer months, milk supplies tighten and demand seasonally increases. Looking specifically at Natural American cheese stocks (Cheddar, Colby and Jack) and calculating the data into a rolling 12-month “days of use in inventory,” the numbers are elevated versus prior years but not at all-time highs that were set in 2013 (see chart accompanying this article).

Do heavy inventories really matter when it comes to where price ranges should trade? In 2013, when natural American days of use in stock were at all-time highs, April and May CME block Cheddar prices averaged more than $1.80 and barrels more than $1.70. But when looking at global cheese prices in comparison to the United States during Q2 2013, Oceania prices averaged $1.94 per pound (USDA Oceania midpoint average) while German Edam prices averaged $2.05 per pound equivalent (Kempton, converting to USD from euros per metric ton). During Q2 2016, Oceania Cheddar prices averaged $1.21 and German Edam at $1.06 per pound equivalent. We believe it is going to be quite difficult to get prices to break out of the past 18-month range and hold there with the U.S. dollar holding at elevated levels versus the euro and global pricing at a sharp discount to domestic levels.

To conclude, how long could the inverted spread last? Those that use CME Class III milk and cheese futures to manage cheese upside risk based on a CME block average want this to last forever as their hedges are outperforming the weekly and monthly averages. On the other hand, block Cheddar manufacturers hedging their inventory and cash-and-carry traders selling premium in deferred futures against physical purchases are nervous as many of those positions would come to term upside down in late Q3 with the spread inverted.

Summer grilling season could keep this spread in place through the end of July but we would imagine a battle would ensue to get things back to normal by August at the latest once barrel demand retreats.

CMN

The views expressed by CMN’s guest columnists are their own opinions and do not necessarily reflect those of Cheese Market News®.

*These observations include information from sources believed to be reliable, but no independent verification has been made and therefore their accuracy and completeness cannot be guaranteed. Opinions and recommendations expressed are the opinion of the authors and are subject to change without notice. The risk of loss in trading futures contracts or commodity options can be substantial, and investors should carefully consider the inherent risks of such an investment in light of their financial condition.

| CMN article search |

|

|

© 2025 Cheese Market News • Quarne Publishing, LLC • Legal Information • Online Privacy Policy • Terms and Conditions

Cheese Market News • Business/Advertising Office: P.O. Box 628254 • Middleton, WI 53562 • 608/831-6002

Cheese Market News • Editorial Office: 5315 Wall Street, Suite 100 • Madison, WI 53718 • 608/288-9090